| Year (j) | Payment # | Amount (x) | Present Value (PV) |

|---|---|---|---|

| 1 | 1 | $50,000.00 | $47,619.05 |

| 2 | 2 | $50,000.00 | $45,351.47 |

| 3 | 3 | $50,000.00 | $43,191.88 |

| 4 | 4 | $50,000.00 | $41,135.12 |

| 5 | 5 | $50,000.00 | $39,176.31 |

Discounting to Present Value

Time Value of Money

Imagine that I offer you $100 today or a $100 a year from now. Are you indifferent? No. All else being equal, you should ask for the $100 today, because a year from now, that $100 will be worth $100 plus whatever rate of return you could get on that $100. For example, at a 5% annual interest rate, at the end of one year, you’d have $105 \((=\$100(1+0.05)^1)\), and thus a return of $5. If you took that total and reinvested it for another year, the two-year return on your $100 would be $10.25, for a cumulative total of $110.25 \((= 100(1+0.05)^2)\).

Now, imagine a defendant who must pay a plaintiff to cover the $100 cost of a surgery scheduled one year from now (a future medical expense). If the defendant paid the plaintiff $100, that defendant would overcompensate the plaintiff by $5. Why? Because the plaintiff could invest that $100 today and, a year from now, would have $105 \((=\$100(1+0.05)^1)\).

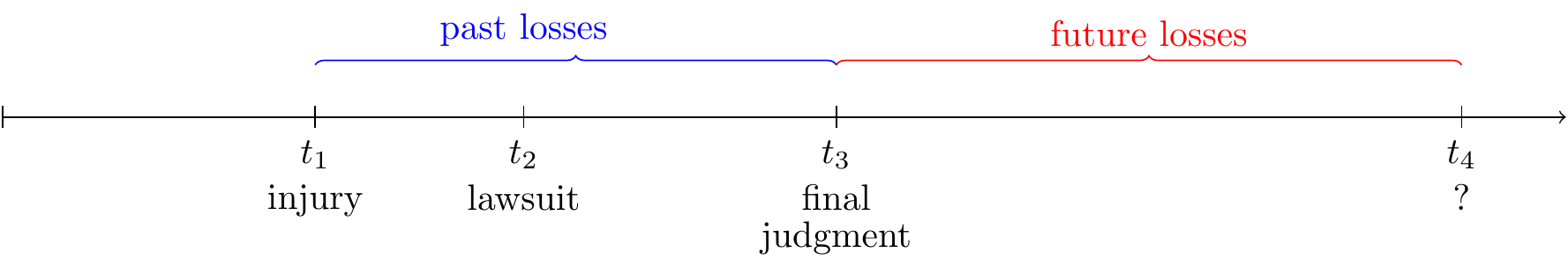

This is a problem with tort damage awards for future losses, i.e., losses caused by the defendant that the plaintiff has not yet incurred (e.g., the cost of a surgery a year from now) but will likely incur after final judgment (Figure 1).

It’s a problem, because compensatory damage awards are supposed to be enough only to put the plaintiff in the the position she would have been had the defendant not acted wrongfully. A dollar more or a dollar less, therefore, over-compensates and under-compensates, respectively.

Thus, if we don’t account for the time value of money, awards for future economic losses will over-compensate the plaintiff. To avoid this problem, when after estimating future economic losses, we discount to present value. Here is the general formula.

\[PV=\frac{FV}{(1+r)^{n}}\]

where \(PV\) = the present value, \(FV\) = the nominal value of the future economic loss, \(r\) is the appropriate annual interest rate, and \(n\) = number of years.

For example, suppose the plaintiff seeks today $100 for a future medical expense that the plaintiff will incur a year from now. Interest rate = 5%. Number of years = 1. To cover that future loss, the defendant should pay not the nominal value of the expense ($100), but \(\frac{\$100}{(1+0.05)^{1}}\) = $95.24.

If the plaintiff seeks today $100 for future medical expense to be incurred two years from now, then the defendant should only pay \(\frac{\$100}{(1+0.05)^{2}}=\) $90.70.

Structured Settlements

Discounting to present value really matters in evaluating a structured settlement offer. A structured settlement is a settlement agreement between the parties that the plaintiff will be paid a certain amount of money in installments over time.

Problem 1: A Simple Problem

You are the plaintiff’s lawyer in a tort lawsuit. On the eve of trial, defendant’s counsel comes to you with a settlement offer: To cover all future medical expenses (the only damages sought in the case), the defendant will make five payments of $50,000 every year for the next five years, with the first payment to be made a year from now. Assume a 5% interest rate. How much is this settlement offer worth today?

Answer: $216,473.83, that is, the sum of the present-value of each payment.

\(PV=\sum_{j=1}^{n}\frac{x_{j}}{(1+r)^{j}}\), where \(n=5\) and \(r=0.05\).

Were you tempted to calculate the value of the offer as $50,000 \(\times\) 5? If so, resist the temptation. Remember the basic intuition: At a 5% interest rate, a $100 today is worth more a year from now ($105) and even more two years from now ($110.25), because you can invest that money today. Each payment is made in a different year.

The key here is that you should discount to present value each payment separately. For example, the present value of the second payment, to be paid two years from now, is \(\frac{50000}{(1+0.05)^{2}}\) =$45,351.47. Then, then take their sum by adding up the amounts in the last column in Table 1.

Problem 2: First Payment Today

You are the plaintiff’s lawyer in a tort lawsuit. On the eve of trial, defendant’s counsel comes to you with a settlement offer: To cover all future medical expenses (the only damages sought in the case), the defendant will make five annual payments of $50,000, with the first payment to be made today. Assume a 5% interest rate. How much is this settlement offer worth today?

Answer: $227,297.53.

\(PV = \sum_{j=0}^{n}\frac{x_{j}}{(1+r)^{j}}\), where \(n=5\) and \(r=0.05\)’

| Year (j) | Payment # | Amount (x) | Present Value (PV) |

|---|---|---|---|

| 0 | 1 | $50,000.00 | $50,000.00 |

| 1 | 2 | $50,000.00 | $47,619.05 |

| 2 | 3 | $50,000.00 | $45,351.47 |

| 3 | 4 | $50,000.00 | $43,191.88 |

| 4 | 5 | $50,000.00 | $41,135.12 |

This is virtually the same as Problem 1, except that the first payment is made today, not a year from now, so its present value is the same as its nominal value.

Problem 3: Payments Vary

The settlement offer on the table concerns damages for lost future earnings. You are absolutely certain that, if the case goes to trial, the jury will rule that, but for the tort, the plaintiff would have worked for the next five years and her (after-tax) annual salary at the end of each of those years would be $50,000, $52,000, $55,000, $58,000, and $60,000. Assume a 3% interest rate. What is the present value of those future earnings?

Answer: $251,180.24.

\(PV=\sum_{j=1}^{n}\frac{x_{j}}{(1+r)^{j}}\), where \(n=5\) and \(r=0.03\)

| Year (j) | Payment # | Amount (x) | Present Value (PV) |

|---|---|---|---|

| 1 | 1 | $50,000.00 | $48,543.69 |

| 2 | 2 | $52,000.00 | $49,014.99 |

| 3 | 3 | $55,000.00 | $50,332.79 |

| 4 | 4 | $58,000.00 | $51,532.25 |

| 5 | 5 | $60,000.00 | $51,756.53 |

The approach is the same as in Problem 1, except that, in this problem, the payment amounts vary by year, and the interest rate is different.

Problem 4: The Rest of Her Life

On the eve of trial, defendant’s counsel comes to you with a settlement offer: The defendant will pay your client $12,500 at the end of each of the next years in the rest of your client’s life, to cover future medical expenses that, because of the accident, your client will likely incur for the rest of her life. As it happens, your client is a white woman who just turned 35 years old yesterday. Assuming a 5% interest rate and that people like your client tend to live, on average, 46 more years, what’s the present value of that offer?

Answer: $223,500.83.

This is basically the same setup as Problem 1, except that the annual payment amount is different and the number of payments is much larger.

Don’t do these calculations by hand. Instead, use a spreadsheet. Most spreadsheet software packages have functions for calculating the present value of a loan or investment. For example, because the problem here involves constant payment amounts subject to a constant interest rate, in Microsoft Excel, you can use the PV function (see function syntax here) by entering \(\text{=PV(0.05, 46, -12500,,0)}\). At the same time, be wary. Make sure you understand how these functions work for your chosen spreadsheet software, and when they won’t work for your given problem.

Problem 5: Using Life-Expectancy Tables

On the eve of trial, defendant’s counsel comes to you with a settlement offer: The defendant will pay your client $12,500 at the end of each of the next years in the rest of your client’s life, to cover future medical expenses that, because of the accident, your client will likely incur for the rest of her life. As it happens, your client is a Hispanic woman who just turned 35 years old yesterday. Assuming a 5% interest rate, what’s the present value of that offer?

Answer: It depends on your estimate of how long after final judgment your client will live.

One way to do this is to use life expectancy tables, such as ones from Centers for Disease Control and Prevention (n.d.). Try it!

Go to the United States Life Tables for 2023 (Arias, Xu, and Kochanek 2025).

Find the table that matches up with your client. Should you use the table for women only? For Hispanics only? For Hispanic women only? Answer: All of them.

For each applicable table, look at the first column to find your client’s age range (35-36).

Run your finger across to the last column (\(e_{x}\)) to retrieve her life expectancy (the expected number of years left in her life).

For each reference class (“everyone”, “women only”, “Hispanics only”, “Hispanic women only”), use the life expectancy estimate to calculate the settlement offer’s present value.

| Reference Class | CDC Table # | Years Left |

|---|---|---|

| Total | 1 | 43.3 |

| Female | 3 | 45.7 |

| Hispanic | 4 | 44.6 |

| Hispanic Female | 6 | 47.3 |

Notice that the “Years Left” column above, drawn from the CDC tables, use numbers with fractions, e.g., 43.3). This creates an ambiguity. The offer is make the annual payments “at the end” of each year in your client’s life. If your client dies before the end of any particular year (say, on December 25), is the defendant obliged to pay all or some of the promised payment (now to the plaintiff’s estate) at the end of that year (December 31)? If not, drop the fraction (e.g., assume your client has 43 years left to life, not 43.3).

For simplicity, we’ll do that here, and then use that to calculate present value.

| Reference Class | CDC Table # | Years Left | Years Left (integer) | PV |

|---|---|---|---|---|

| Total | 1 | 43.3 | 43 | $219,323.90 |

| Female | 3 | 45.7 | 45 | $222,175.87 |

| Hispanic | 4 | 44.6 | 44 | $220,784.67 |

| Hispanic Female | 6 | 47.3 | 47 | $224,762.70 |

Now, choose a reference class and be prepared to defend the associated present value of the offer. In this problem, there’s at most a $5,438.80 difference between reference classes. (Which reference class you choose might depend on whether you represent the plaintiff or the defendant.)

A key question is whether that difference is caused (directly or indirectly) by illegal or unfair race/gender discrimination. (Why, for example, do women tend to live longer than men?) If it is, then we are back to the fairness v. accuracy debate.

Also, what if the injury caused the plaintiff to have fewer years of life left than the average otherwise-similar person without that injury? If so, relying on the CDC life expectancy tables may over-estimate how long he or she has to live.You’d need data on life expectancy of otherwise similar people with that kind of injury.

Also consider whether similar concerns arise when lawyers rely on race-specific or gender-specific averages to estimate a plaintiff’s career earnings capacity (e.g., Soffen 2016). Worklife expectancy at a certain age denotes the average number of years that a person of that age in a given cohort will spend either working or actively looking for work during the rest of his or her life. Worklife expectancy is usually less than life-expectancy, because most people will typically stop working or looking for work before they die.